TX AP-228-1 2017 free printable template

Show details

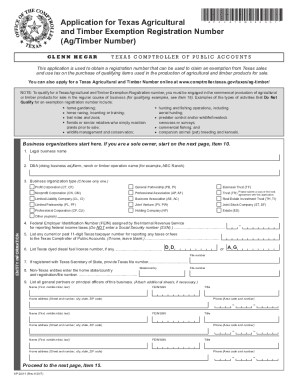

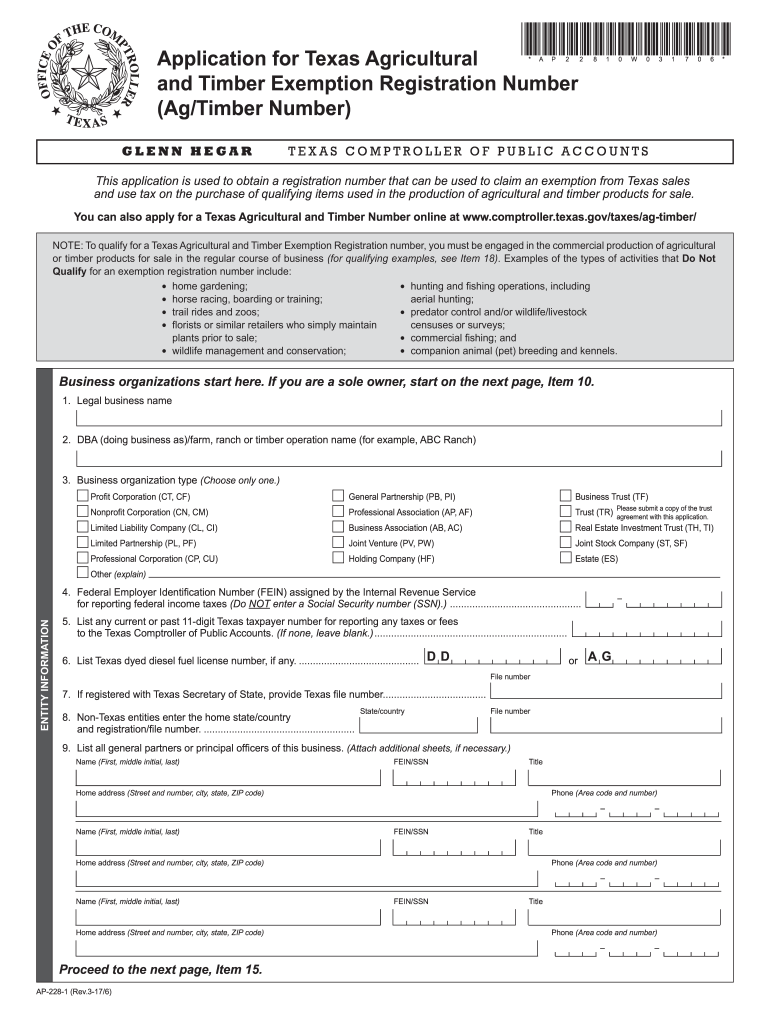

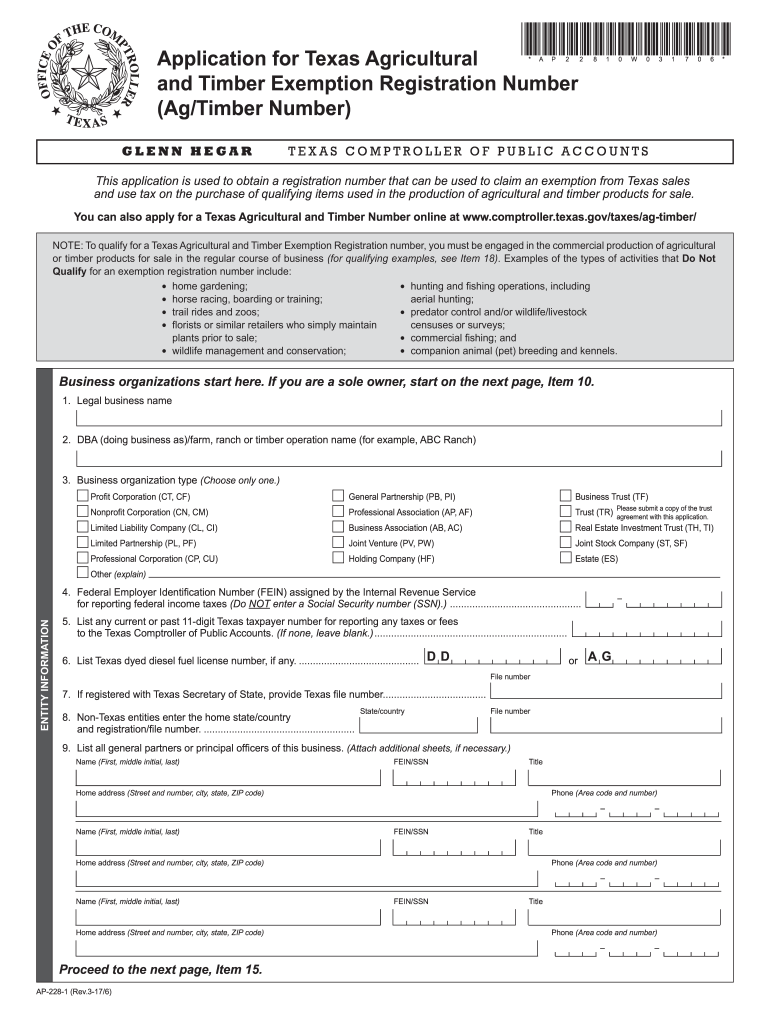

Physical location - This address is for the primary physical location where business is conducted and/or where agricultural or timber products are grown or raised for sale. You can also apply for a Texas Agricultural and Timber Number online at www. comptroller. texas. gov/taxes/ag-timber/ NOTE To qualify for a Texas Agricultural and Timber Exemption Registration number you must be engaged in the commercial production of agricultural or timber products for sale in the regular course of...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX AP-228-1

Edit your TX AP-228-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX AP-228-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TX AP-228-1 online

Follow the steps below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit TX AP-228-1. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX AP-228-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX AP-228-1

How to fill out TX AP-228-1

01

Begin by downloading the TX AP-228-1 form from the Texas Comptroller's website.

02

Fill in the name of the individual or business entity at the top of the form.

03

Provide the account number associated with your tax or business registration.

04

Specify the type of tax or exemption you are applying for.

05

Fill out any necessary details regarding the nature of your exemption.

06

Ensure to include contact information, including phone number and email, for any follow-up.

07

Review the completed form for accuracy and completeness.

08

Submit the form as instructed, either via mail or electronically, depending on the requirements.

Who needs TX AP-228-1?

01

Business entities or individuals seeking to apply for sales or use tax exemptions in Texas.

02

Organizations that qualify for tax exemptions under certain criteria, such as non-profits.

Instructions and Help about TX AP-228-1

Hi farmer ranch customers we're here today to let you know about some new changes that are coming through the state of Texas any purchases made after January first 2012 will require a new agricultural permit or sales tax will be charged to find out more information about this you can visit word Texas org and find out more you

Fill

form

: Try Risk Free

People Also Ask about

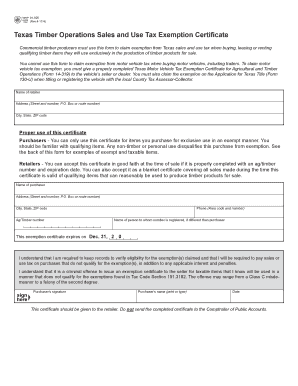

What is the ag exempt form 01 924 in Texas?

Commercial agricultural producers must use this form to claim exemption from Texas sales and use tax when buying, leasing or renting qualifying agricultural items they will use exclusively in the production of agricultural products for sale.

How do I renew my Texas agriculture or timber registration?

Call the comptroller's office at 1-844-AG RENEW (1-844-247-3639). This telephone line is available for ag/timber renewals 24-hours per day, seven days a week. Once you've completed the process it will take two business days for your ag/timber number to be renewed.

How many animals do you need for an ag exemption in Texas?

Travis Central Appraisal District. How many animals do I need on my property to qualify for Agricultural Valuation? The minimum requirement for grazing stock is 4 animal units. A grazing livestock animal unit equals; 1 mature cow; 2 five-hundred pound calves; 6 sheep; 7 goats, or 1 mature horse.

What is Texas agricultural or timber registration?

An agricultural or timber exemption certificate is required when you claim a sales tax exemption on the purchase of items directly used to produce agricultural and timber products being raised or harvested for sale.

How to apply for a Texas agricultural and Timber registration number?

You can print the application (PDF) and mail the paper version to us. Allow three to four weeks for processing time. Additionally, you can call our Fax on Demand service at 1-800-531-1441, or call 1-800-252-5555 to ask for an application to be mailed to you.

How do I get a farm tax exempt number in Texas?

To claim a tax exemption on qualifying items, you must apply for an agricultural and timber registration number (Ag/Timber Number) from the Comptroller. You must include the Ag/Timber Number on the agricultural exemption certificate (PDF) or the timber exemption certificate (PDF) when buying qualifying items.

How many acres do you need for timber exemption in Texas?

How many acres do you need to be ag exempt in Texas? Ag exemption requirements vary by county, but generally speaking, you need at least 10 acres of qualified agricultural land to be eligible for the special valuation.

What is Texas agricultural or timber registration?

Several of you have been contacting our office about renewing your Texas Agricultural and Timber Registration Number. This program is administered by the State Comptroller's Office and allows producers to purchase certain items for their operation without paying sales tax.

How do I renew my Texas agricultural or timber registration?

Call the comptroller's office at 1-844-AG RENEW (1-844-247-3639). This telephone line is available for ag/timber renewals 24-hours per day, seven days a week. Once you've completed the process it will take two business days for your ag/timber number to be renewed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send TX AP-228-1 to be eSigned by others?

TX AP-228-1 is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I create an electronic signature for the TX AP-228-1 in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your TX AP-228-1 in seconds.

Can I edit TX AP-228-1 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share TX AP-228-1 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is TX AP-228-1?

TX AP-228-1 is a Texas tax form used for reporting certain transactions related to specific taxes imposed by the state.

Who is required to file TX AP-228-1?

Individuals or businesses that engage in taxable transactions that fall under the jurisdiction of the Texas Comptroller are required to file TX AP-228-1.

How to fill out TX AP-228-1?

To fill out TX AP-228-1, taxpayers need to provide specific information on the form regarding the transactions being reported, including details such as dates, amounts, and types of transactions.

What is the purpose of TX AP-228-1?

The purpose of TX AP-228-1 is to ensure that taxpayers accurately report taxable activities and comply with Texas tax regulations.

What information must be reported on TX AP-228-1?

TX AP-228-1 requires reporting information like the taxpayer's name, address, the nature of the taxable transactions, relevant dates, and transaction amounts.

Fill out your TX AP-228-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX AP-228-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.